What We Do

We help Private Banking & Wealth Management companies maximise Return-on-Automation & build strategic IP through providing technology consulting and implementation services to support digital transformation.

Our experts have worked in the banking and wealth management industry, benefiting clients with our technical expertise. We consult with and advice our clients on proposition development, client service and business improvement using cutting edge technology, incorporating risk control and corporate governance.

Consultancy

Supporting digital transformation projects through a combination of technology consulting and full implementation services.

System Integration

We combine deep domain expertise and understand the business challenges faced by the front, middle and back-office with intelligent automation (IA) and intelligent document processing (IDP) capabilities.

Intelligent Glue

Our philosophy is to work with clients existing infrastructure, connecting systems & data to deliver automation solutions that deliver genuine results and change.

Value

Our mission is to accelerate business value by delivering and implementing solutions within 90 days.

How We Work

Domain Expertise

Supporting clients - dedicated specialist team with extensive knowledge and experience in Private Banking and Wealth Management.

Automation Assessment

Identifying priority areas and business case - aligned to business strategy.

Data Strategy

Define and capture data requirements - improving decision-making quality and accuracy

Technology, Tools & Architecture

Supporting multiple applications - improving user experience and enabling faster solution implementation

Bespoke Solution Design

One size doesn’t fit all – our solutions are designed recognising businesses are unique.

Agile Delivery

Customer-centric - simplifying process decisions around incremental and iterative solution delivery.

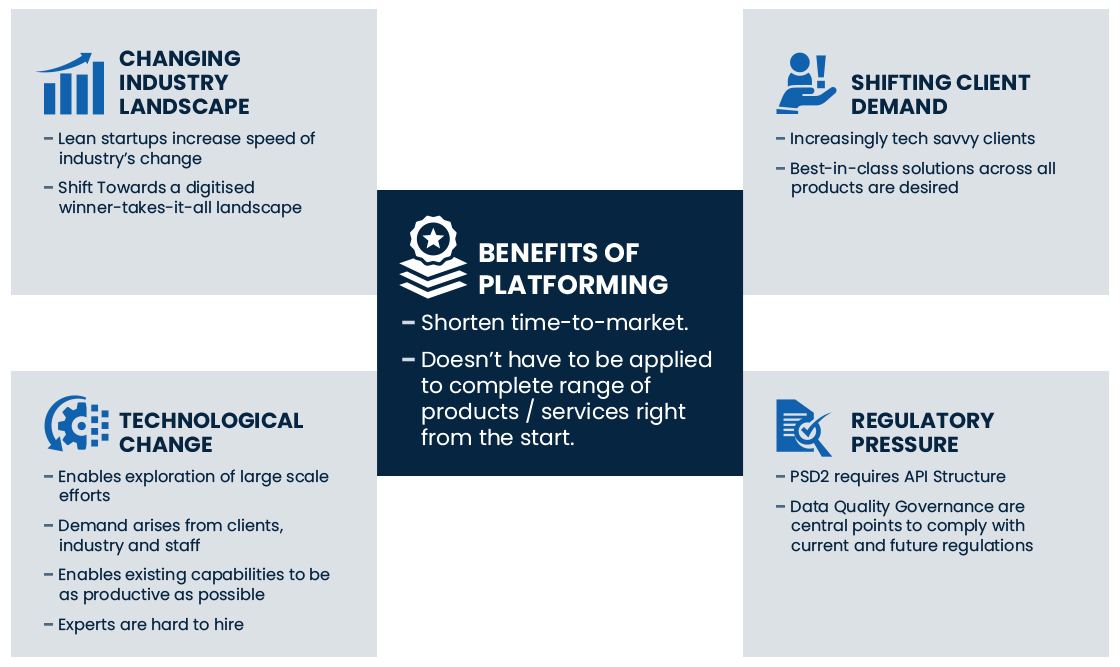

Digital platforms have become a key requirement but its knowing what strategy is right for you.

The best platform is not the one that can collect the most data but can efficiently convert that data into actionable information.

Benefits & Outcomes of Intelligent Automation

Our technology consulting and implementation services support digital transformation of Private Banking & Wealth Management firms by combining deep domain expertise with intelligent automation capabilities.

Ripping out legacy systems is risky and expensive, our approach is different. We use ‘Intelligent Glue’ to connect and enhance existing systems & data to deliver an immediate return. We implement at speed – our golden rule is that implementations must be live and start to add value in 90 days.

Our Expertise

Rapidly changing compliance rules mean manual processes aren’t practical or reliable. We help clients automate processes such as client due diligence to mitigate risks and be agile enough to fulfil future obligations.

Our intelligent glue helps you design the right journey for your business, achieving digital first process automation.

Keep a competitive edge with our three-pillar approach to operational excellence focusing on people, process and automation.

Transparent and accurate ESG data reporting through automation, enabling you to comply with the changing regulatory landscape both now and in the future.