For many ambitious Alts or Private Capital firms, a slow and hard-to-coordinate fund setup process is causing ripple effects: It risks …

The Problem

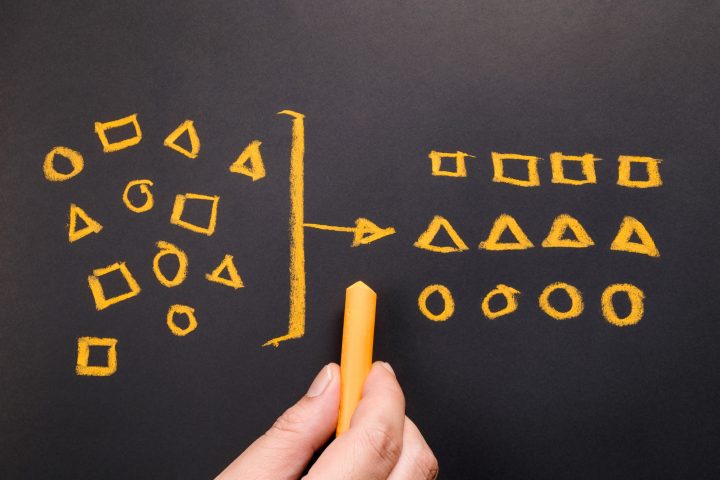

Ambitious Private Capital & Alternative Asset Managers work with psKINETIC to speed up automation and digital transformation. Based on our experience, we realise that Asset Managers already have a number of systems and processes in place – our focus is helping clients intelligently ‘glue’ together existing IT and people who often works in different departments/different geographies.

We typically work in challenging business process areas where there is no natural ‘off-the-shelf’ solution. Optimising the New Fund Setup process embodies this thinking.

The Fund Setup process stubbornly remains a highly manual, cumbersome and time-consuming process. The process itself is a complicated web of checklists, documentations and planning; it leans heavily on legacy technology such as spreadsheets, text documents, email, and PDF across multiple teams in multiple geographies. The lack of a natural and complete solution has meant the setting up a new fund is more inefficient, slow, and frustrating.

The result: You keep having to hire people and your business is unable to take advantages of new market opportunities costing you revenue and reputation. Operationally, your current solution is inhibiting scale.

Our

Fund Setup

Solution

We believe that return on technology comes from intelligently ‘gluing’ together existing systems and processes. Our Fund Setup is built from ground up to enable rapid configuration to suite your processes and integrate with your existing systems.

We centralise all workflow, tasks, deadlines and data in one intuitive user interface. You can make sure the right team has access to the right part of the process, this includes third parties such as legal counsel or other advisors.

Typically, we can automate 90% of the processes from start to finish, including

- New Fund Setup

- New Product Approval Forms

- Private Placement Memorandum

- KPI & SLA Reporting

- We also offer a solution to manage cumbersome side letters (see Investor Onboarding)

Benefits

The tool is intuitive and can be tailored to your specific needs.

The tool is intuitive and can be tailored to your specific needs.

Launch funds quicker

Avoid constant headcount increase

Better control, better data

Insights

The Drawdown Article – CTOs: Dealing with (unfair?) pressure

This article featured in The Techwork 2022 Report. CTOs and COOs in Alts/Private Capital are coming under ‘unfair’ pressure as complexity …

Institutional Onboarding: What’s The Problem?

The institutional onboarding process is often ‘broken’. It is not scalable, can delay revenue, will drive up costs, and can even …