Capital Calls: Perfect for Robots? “Robotic process automation has been around for years, but I’ve never come across a good use …

The Problem

Private Capital and Alts have a number of relatively high-volume processes where use of RPA can deliver tangible cost savings, speedier operations and happier staff.

Capital Calls is a good example. Its repetitive and moderately complex, but the actual process does not require human input (once decision is made to call).

The investment in robots can add good ROI for a number of use cases; to get strategic value and enable scale (and not keep hiring expensive people) requires more of a strategic vision and smart prioritisation of where bots create most value.

The savvy CTO or COO has three tools he or she can deploy:

- BPM for workflow with a lot of user engagement and where you combine data, process and human judgement. Good examples include LP Onboarding, Fund Set-Up and Deal Closing

- Integration engines for well-established processes with well-defined APIs to enable system to system automation

- RPA/Robots as a short-cut where APIs are hard to use, volumes are not very high, and mimicking a human operator is quicker.

Capital Calls is an excellent example of an RPA use cases. Given the accelerating number of funds across strategies/asset classes and geographies and a growing number of LP, this process is becoming a time-consuming – it is still highly manual, error prone and slow.

Our Capital Calls Solution

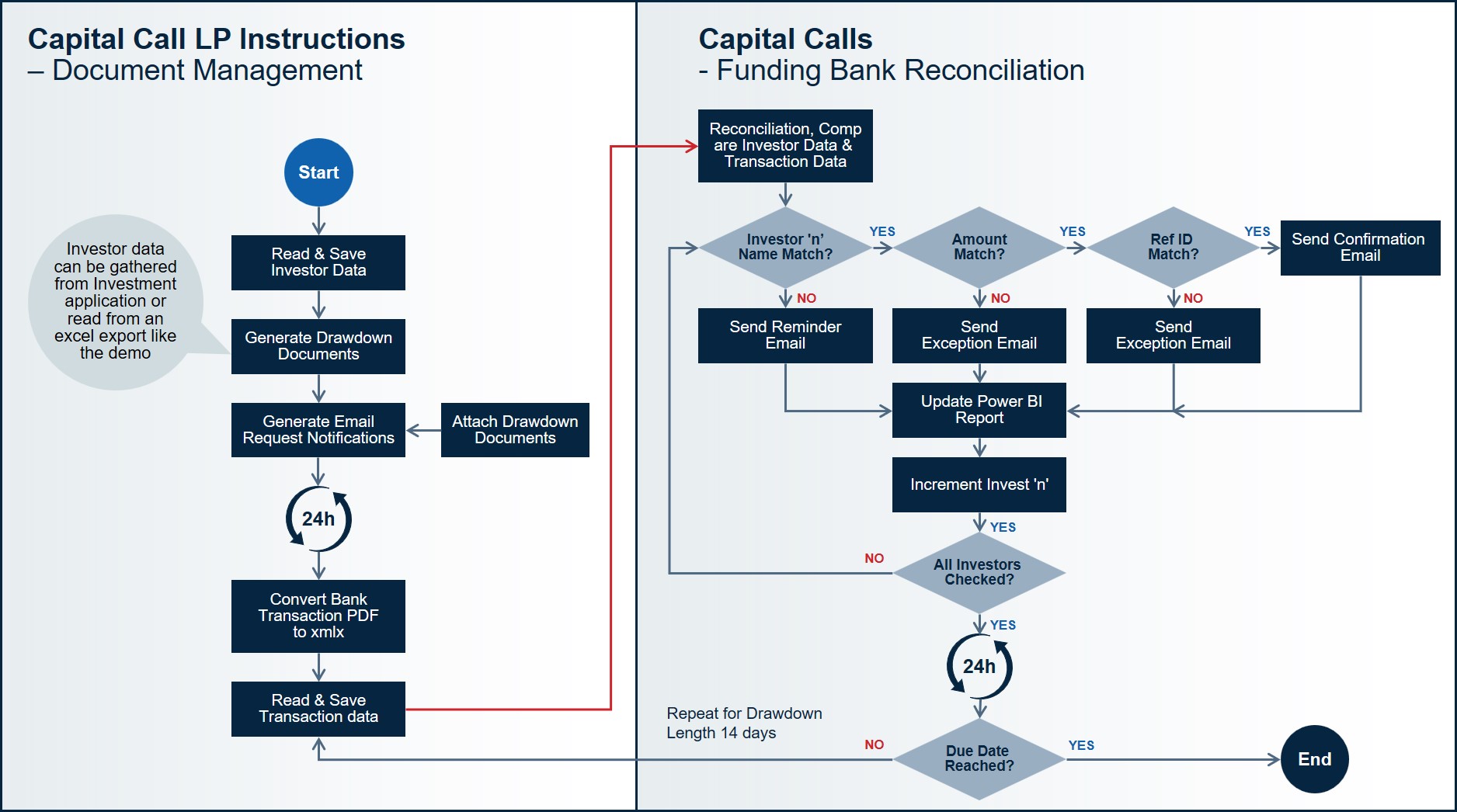

The psKINETIC solution uses a trained robot to navigate between a number of systems and a few excel sheets automating the steps below:

Step 1: psKINETIC’s trained robot is triggered and subsequently accesses LP funding data by logging into system of record.

Step 2: Using data from another system or database (or excel), the robot generates an automated, individual drawdown request for each of the 200 LPs combining data such as contact information, bank details, due date, $ capital called, and cumulative capital called so far…

Step 3: psKINETIC’s robot then generates an email, again using a template populated with LP specific information taken from the data source and attaches the drawdown request that has been created for each LP.

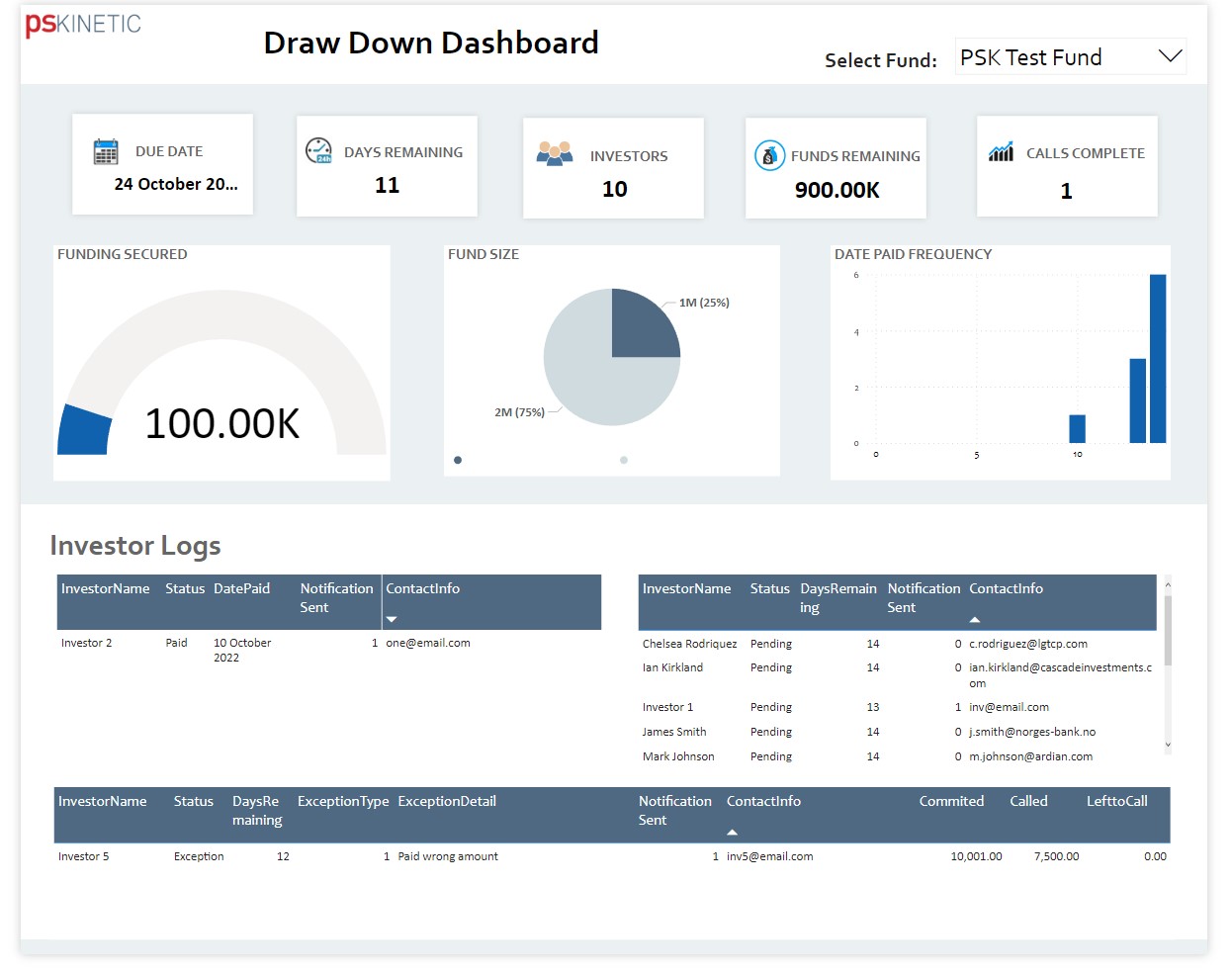

Step 4: Over the following 14 days, drawdowns are wire transferred by each of the 200 LPs to fulfil their commitment. At this stage, robot in reconciliation mode, reads updated copies of bank statements and matches drawdown requests with LPs.

Step 5: Diligently psKINETIC’s robot records the transactions for each LP, delivering the ability to create a Power BI capital call dashboard, plus logs into another system and records critical drawdown funding data for each of the 200 LPs. psKINETIC’s robot is also trained to find and flag funding errors providing an exception pathway. This completes the full drawdown loop.

Benefits: Hard Cost Savings, Speedier, Happier Staff

The robot can free up significant team time. We have an ROI excel model that you can tailor to your set-up. Fundamentally, we believe that if you have 2-3 funds with 150-250 LPs calling 2 to 3 times a year – you immediately have a very good return.

The Robot is less prone to make mistakes and makes is easier to deal with peaks and troughs allowing your staff to focus on higher value work.

Once you have deployed a robot, it is likely that you and your team will find new uses cases to drive the cycle of automation and continuous improvement.

Get in touch to discuss our ROI model.

Insights

Data: What’s the Endgame?

CTOs and COOs in private capital are surrounded by smart, analytical dealmakers who all talk about investing in companies that are …

Institutional Onboarding: What’s The Problem?

The institutional onboarding process is often ‘broken’. It is not scalable, can delay revenue, will drive up costs, and can even …