For many ambitious Alts or Private Capital firms, a slow and hard-to-coordinate fund setup process is causing ripple effects: It risks slowing …

Capital Calls: Perfect for Robots?

“Robotic process automation has been around for years, but I’ve never come across a good use case in private capital,” said an ambitious CTO. In response, we queried: “So, you don’t have complex, repetitive processes? And you don’t have expensive, trained staff search for and re-key data between systems and excel sheets?”

Managing operations or finance for a private capital firm is not what it was 5 or 10 years ago. From a few, relatively simple, private equity deals (from an ops point of view) firms have expanded at speed – in transaction volume, asset classes and investor types.

Spurred on by strong institutional demand and the need to chase alpha, private capital firms are offering an unprecedented variety of products to a wide range of clients, covering every dimension – products, asset classes, legal entities, jurisdictions, big ticket, small ticket, infrastructure, private credit…special situations and everything in between.

Complexity & Negative Economies of Scale

McKinsey recently suggested that at roughly $8-10bn in assets many private equity firms are experiencing diseconomies of scale. Counter intuitive? The problem is complexity; the expected incremental efficiencies are not only absent but often reversed. The most challenging areas are typically in finance, operations, compliance, and HR.

A great source of complexity is the way firms are ‘forced’ to work with LPs. Today GPs are having to accept an array of tailored structures and investment mandates, including proliferating SMAs, complex sidecars/co-investment structures and opt-outs due to ESG, regional or industry focus.

Unconnected systems, excel & email: Intelligently gluing it all together

COOs and CTOs are turning to digital solutions to enable scale. In this blog we are focused on the actual tech, but smart ops, finance and tech executives are clear on one thing – good business analysis, clear and prioritised requirements are also sine qua non for success.

Automation and gluing together systems can typically be approached in two ways: Either by using a comprehensive low code workflow automation platform or a more tactical robotics process automation (or RPA for short). Intelligent RPA can mimic human work with greater speed, zero error rate and work across all time zones 365 days a year. RPA is also not reliant on APIs and software vendor support; too often projects are on hold ‘awaiting’ elegant integration when a robot can do the job far more easily/effectively.

RPA can deliver quick returns for GPs by intelligently automating common, repetitive yet complex, tasks. Avoid the cycle of adding ‘just adding one more person” to the team as you are raising new funds and battling with multiple closes, onboarding investors or managing multiple capital calls. Instead, streamline the process and deploy a robot.

A robotic program is best run-in iterative cycles, eliminating low hanging fruit before moving on to more complex work. Management of capital calls or the fund in/fund out processes are good challenges for RPA. Both require numerous look ups, validations, data re-keying and analytics across multiple segregated business roles (finance, accounting, treasury functions). Automating these areas frees employees from burdensome work so they can focus on value-adding activities – enabling firms to retain top talent and improve performance.

Capital Calls: Perfect For Robots

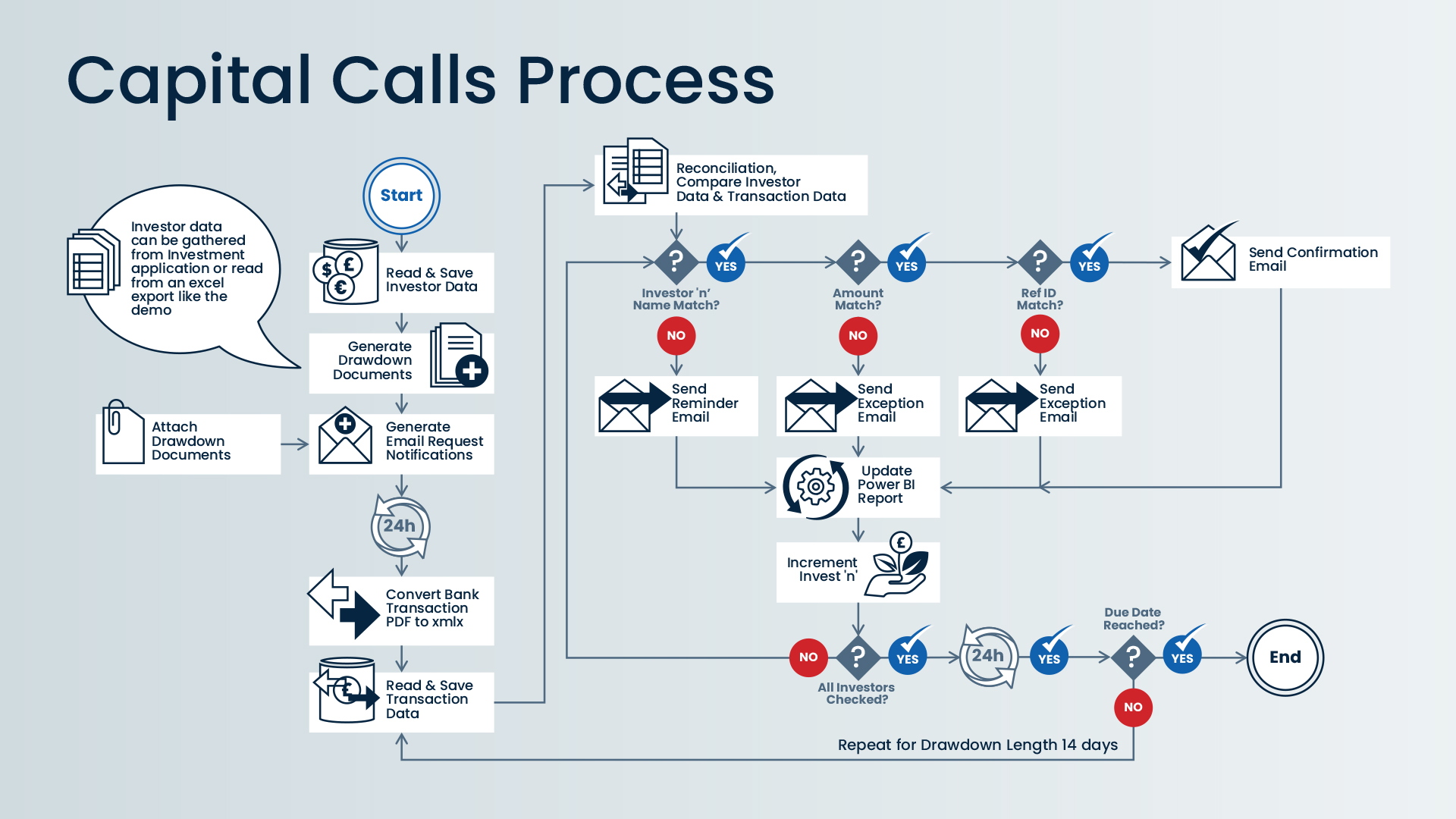

So, just how could RPA replace humans for the capital call process?

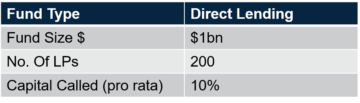

Here is a breakdown of the fund we will target using automation:

Step 1: psKINETIC’s trained robot is triggered and subsequently accesses LP funding data by logging into another system or database.

Step 2: Using data from another system or database, the robot generates an automated, individual drawdown request for each of the 200 LPs.

To do this our robot takes the data that is has accessed and inputs the individual details of each LP into a drawdown request template – in doing so creating 200 drawdown requests. The document contains specific LP information such as their contact information, bank details, due date, $ capital called, and cumulative capital called so far…

Step 3: psKINETIC’s robot then proceeds to generate an email, again using a template populated with LP specific information taken from the data source, and attaches the drawdown request that has been created for each LP. The drawdown request email is subsequently sent to each of the 200 LPs contact email address.

Step 4: Over the following 14 days, drawdowns are wire transferred by each of the 200 LPs to fulfil their commitment. At this stage, psKINETIC’s robot is trained to change guise, moving into reconciliation mode. Every day our robot reads an updated copy of the bank statement for the funds account and searches for new capital calls wire transfers.

Step 5: Diligently psKINETIC’s robot records the transactions for each LP, delivering the ability to create a Power BI capital call dashboard, plus logs into another system and records critical drawdown funding data for each of the 200 LPs. psKINETIC’s robot is also trained to find and flag funding errors providing an exception pathway. This completes the full drawdown loop.

See our robot manage Capital Calls process?

We would be delighted to run a demo to show you how effective a robot can automate the Capital Call process from issuing the call, getting funding date confirmation, checking bank accounts, reconciling GP payments, following up on potential delays…All the while providing you with real-time reporting.

Contact: Alex Tyler

Head of Private Capital

psKINETIC

E: alex.tyler@pskinetic.com

www.linkedin.com/in/alextylerpskinetic/

Insights

Deal Due Diligence – Time For Digital Transformation?

Private Capital: Digital Transformation of Deal Due Diligence What do the most successful private equity, private debt, and other alternative asset managers …

Client Onboarding – How (un)-Intelligent Is Your Process?

The challenge sneaks up on you, slowly: A regulatory amendment, expansion into a new jurisdiction or launch of a new product. A …

Tech & Data: Why Is Everything Taking So Damn Long?

In my discussions with senior leaders of Alternative Asset Management firms, I often hear the same refrain: “why is it taking so damn long?” or “when am I actually going to see return on my tech or data investment?”

Want a solution? Then check out these 6 Rules.