For many ambitious Alts or Private Capital firms, a slow and hard-to-coordinate fund setup process is causing ripple effects: It risks slowing …

Ambitious Private Capital and Asset Managers are all looking to expand. With an increasingly diverse investor-base, new asset classes, and a growing number of jurisdictions/regulators, the process of setting up new funds is becoming more complex – from ideation, through fund structuring, approvals, regulatory issues, and operational constraints.

Before getting into the tech, what is the business case?

It is pretty simple. The world is moving faster, funds are being spun up to take advantage of new market opportunities and strategies, and big investors are demanding SMA/fund-of-one treatment.

The revenue opportunity: Getting out of the blocks earlier will drive fee income. One manager said, “For every month we delay $1 billion of onboarded/committed funds, we basically lose out on $1 million”. Streamlining Fund Setup should reduce time to market by at least 30%.

The cost saving opportunity: You can keep throwing bodies at the problem, but it’s costly and continued manual (including excel and email) processes do not scale. Without considering an increase in new funds/new structures, you should be looking to save (or re-deploy) FTE.

The important, but less easily quantifiable, opportunities: (i) Better client experience (further driving revenue); (ii) better regulatory/compliance control; and (iii) better for your talented staff.

Suitable tech ‘off-the-shelf’? No

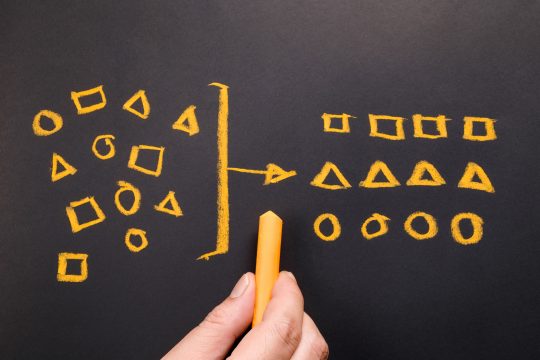

We have not seen useful ‘off-the-shelf’ solutions in the Fund Setup & Lifecycle process. The reason being that these processes are typically hyper-customised. Over time, the process has grown organically using excel, email and typically a document management system (maybe SharePoint). The process also cuts across multiple departments who already have their own processes, sometimes supported by systems.

Build from scratch? Poor use of resources

Building a system from the ground up requires product development and engineering skills that are increasingly scarce. In any organisation, there will be a team that can cobble something together. The problem is that this method typically lacks end-to-end product ownership and a systematic approach to maintenance and improvements. Also, internal teams often have a blind spot in that they are not aware of best practice in the industry.

Use flexible workflow framework? Probably

In our experience, the challenge of Fund Setup is best solved using a low-code workflow/BPM system that generically handles tracking of tasks/SLAs, etc well, yet is very flexible and builds on a foundation that is constantly upgraded and maintained.

Such a workflow/BMP platform – combined with good implementation experience – should be able to intelligently glue together your Fund Setup and Lifecycle process within 90 Days.

Contacts us for a demo of our Fund Setup workflow automation solution.

Alex Tyler

Head of Private Capital

psKINETIC

E: alex.tyler@pskinetic.com

www.linkedin.com/in/alextylerpskinetic/

Insights

Deal Due Diligence – Time For Digital Transformation?

Private Capital: Digital Transformation of Deal Due Diligence What do the most successful private equity, private debt, and other alternative asset managers …

Client Onboarding – How (un)-Intelligent Is Your Process?

The challenge sneaks up on you, slowly: A regulatory amendment, expansion into a new jurisdiction or launch of a new product. A …

Tech & Data: Why Is Everything Taking So Damn Long?

In my discussions with senior leaders of Alternative Asset Management firms, I often hear the same refrain: “why is it taking so damn long?” or “when am I actually going to see return on my tech or data investment?”

Want a solution? Then check out these 6 Rules.