For many ambitious Alts or Private Capital firms, a slow and hard-to-coordinate fund setup process is causing ripple effects: It risks slowing …

CTOs and COOs in private capital are surrounded by smart, analytical dealmakers who all talk about investing in companies that are data savvy; LPs evaluate data maturity. But how advanced are the PE, Private Credit and Alts firms themselves?

“We are chasing alpha in new asset classes and unexplored opportunities, we exploit messy data,” said the deal maker. “No innovation since the invention of the Excel spreadsheet,” quipped one data scientist. Both perspectives have some merit.

The market for Private Capital is ballooning in size and importance. It is also becoming more like traditional asset management: consider the rapid emergence of secondaries, new retail investor pools, its increasing regulation and expansive reporting pressures.

In parallel, ‘operational cycles’ are speeding up, moving the industry from a mindset of ‘one big decision at the time’ to the management of continuous processes. “5 years ago, we raised a fund every third year. Now we are always fundraising and onboarding LPs,” says one Chief Operating Officer.

All these point to the growing importance of data, particularly data beyond that used by the investment team.

Data: Begin with the end in mind

Before thinking about ‘the endgame’ for data, let’s us consider the purpose. Simply put, firms want to make better decisions. ‘Good’ data should lead to better insights, and consequently, better decisions. This applies across the value chain from raising capital (fund setup, LP onboarding) to investing capital (deal execution, monitoring).

So, who is in the vanguard of delivering insights? There is an interesting idea that in the end, data and analytics become ‘invisible’ – users are just provided the actual insight: Netflix does not show you the data or the tool, it simply recommends movies; Google Analytics minimizes focus on the actual tooling to bring continuous insights to the fore.

For COOs and CTOs as leaders in operations and technology, the journey has barely started. The endgame is moving away from a focus on tools (the data warehouse, the PowerBI app) to a focus on continuous insights enabling better decisions – which are tracked and feed further insights enabling better decisions.

Dark Data: Biggest ‘violation’ in private capital?

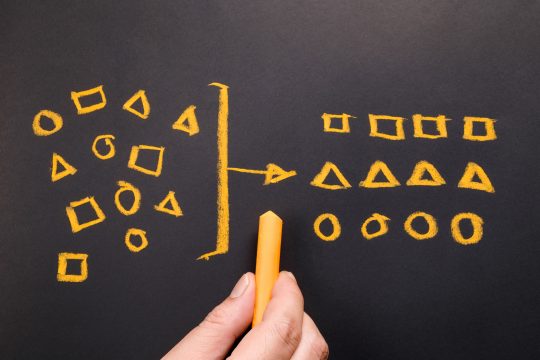

Maybe the biggest ‘violation’ of good data practice is a propensity to collect data once and then fail to reuse it. Data is received in thousands of PDF documents, or collected and manipulated in excel or in stand-alone systems – but only used for a single purpose or single transaction (e.g. a side-letter with an investment mandate or a deal execution check-list) – it becomes dark data. Information assets are collected, processed, and stored during regular business activities, but firms fail to re-use them for other purposes (for example, analytics, business relationships and direct monetizing). IDC suggests that dark data is growing at 60% per year and that as little as 2.5% of enterprise data is actually analysed.

LPs & Data: Greater demands

It is widely accepted that PE firms gravitate towards picking portfolio companies that exhibit an ability, or capacity, to support data analytics. Limited partners are doing the same, they are starting to judge general partners by their digital maturity and savvy use of data analytics. No wonder the digital experience of LPs is becoming important to GPs – it is part IR and fundraising!

Fundraising and LP management are both becoming more complex and perpetual. As LPs aggregate larger pools of capital, they are increasingly expecting GPs to execute their (the LP’s) investment strategy via opt-ins and co-investment rights. LPs are demanding more tailored treatment with challenging investment mandates, restricted lists, or management through SMAs.

At the same time, fund raising is becoming continuous. Firms are now ‘always’ raising and closing funds or special vehicles across multiple jurisdictions and time zones.

Data-Driven Investment Mandates & Allocation

Both deal makers and ops/tech leaders are beginning to feel the pain of LPs’ demands. Investment Mandates (dark data hidden in a side-letter?) may impact deal sourcing and will certainly impact deal closing and fund allocation. They will also impact questions of dry powder when evaluating transactions. Here the journey is pretty clear: Firms will need to collect and store data for re-use so that better decisions can be made in near real-time.

As regards to deal closing, moving to deal checklists that are dynamic and where data can be re-used is part of building a smooth handover from investment teams to operations and finance. A good example of data re-use is the triggering of dynamic tasks for ops or finance based on anticipated close date and expected funding.

Reporting to LPs is another challenge. Demands on tailored reporting, including the use of LPs classifications, is on the rise. This is beyond providing portals (which are helpful). In the future, GPs are likely to increasingly provide direct data access so LPs on their side can aggregate their data across large portfolios of investments across GPs. One day, GPs may be connected with real-time data from their portfolio companies that is then relayed in real-time to LPs.

CTO/COO: How to deliver data insights?

Firstly, keep in mind the goal is to provide continuous insights. Resist the temptation to do lots of ad hoc analysis.

Second, to build the infrastructure for continuous insights you need data that is defined and of high integrity. Unless you define the process and repeatedly use that process, you will simply create more dark data. Don’t think about data separate from the process. Don’t think that ‘AI’ will miraculously fix the problem – don’t get distracted.

Third, don’t start with deal sourcing. Although this topic gets a lot of attention, setting up continuous processes and getting the investment team to adopt systems is very hard. Be a role model, show how you can deliver continuous insights from LP Onboarding, Fund Setup and Deal Closing by gluing existing systems and processes together – avoiding dark data.

Alex Tyler

Head of Private Capital

psKINETIC

E: alex.tyler@pskinetic.com

www.linkedin.com/in/alextylerpskinetic/

Insights

Deal Due Diligence – Time For Digital Transformation?

Private Capital: Digital Transformation of Deal Due Diligence What do the most successful private equity, private debt, and other alternative asset managers …

Client Onboarding – How (un)-Intelligent Is Your Process?

The challenge sneaks up on you, slowly: A regulatory amendment, expansion into a new jurisdiction or launch of a new product. A …

Tech & Data: Why Is Everything Taking So Damn Long?

In my discussions with senior leaders of Alternative Asset Management firms, I often hear the same refrain: “why is it taking so damn long?” or “when am I actually going to see return on my tech or data investment?”

Want a solution? Then check out these 6 Rules.