Where to Start?We began our journey into Intelligent Document Processing with a large healthcare contract 8 years ago. The challenge was to …

Getting into Business Banking

Neobanks are best known for consumer banking offerings, however, there is a significant march of digital-first banks moving into business banking, which is not surprising due to the higher value of business customers to standard consumers.

Recent studies have shown that 10% of start-up businesses have their main business bank accounts with Neobanks like Starling, Revolut, and Monzo.

High barriers to market have traditionally made it very difficult for new players to get into the sector, but with recent innovations, and the success of consumer digital-first banking, it’s only natural to see them move into Business Digital Banking.

With Neobanks building capability through updated architecture, multi-layer workflows, and the ability to roll out new features at speed, they are posing a threat to the existing incumbents.

There is a perceived social barrier and concern for business to put all their finances in a digital-only environment with potentially higher risk returns.

One key area is payment providers. Recently “payments” have become sexy again with tech being used to manage merchant providers. Originally this was with just the B2C model, but I am now starting to see a lot of movement in the B2B market as well. Even some very large established payment providers are looking to change tech because what they are using does not fit their customer journey and is ultimately costing them more money in the long run. This is especially true with business banking and payment providers.

A key reason for the change is the popularity of Neobanks and their proven ability to change the incumbent’s model, offering solutions via digital channels. A large proportion of businesses still want to be able to pick up the phone and speak to their bank manager or go in and see them if needed. This is not a service Digital Banks offer, or if they do only in limited form.

The SME market seems to be the ideal playground for Neobanks moving into business banking. Firstly, SME’s are generally the most underserved business group and more likely to switch their banking habits. Secondly, whilst large, the SME market in the UK is less likely to be attacked or threatened by big tech due to the lower return opportunities. This is a huge market for microenterprises and freelances which have generally always been missed by the bigger traditional banks.

When looking at the numbers, it’s an attractive opportunity. The Bank of England’s recent report on SME Funding suggests SME’s employ 60% of the private sector and provide 50% of the national GDP. Whilst 50% of SMEs only consider one provider when looking for finance, 60% of would-be borrowers resort to personal funds as it is too difficult or convoluted to get business financing.

Banking-as-a-Service

One in six businesses are already using digital-only banking which includes customers from traditional business banks. Other studies have shown that up to 21% of businesses say that utilising only digital banking would be their first choice, 23% saying they would seriously consider it, and 38% rejecting digital banking for traditional banking offerings.

With the rise in banking as a service, these numbers in my opinion will only increase, but wait, before we go on to what is “Banking as a Service”, probably easier if I explain through example. Imagine you are the manager of a supermarket and are facing increased competition which is eating into your customer base. You want to offer more services to your customers, perhaps a debit card that would allow you to award them loyalty points whenever they make a card payment. Each time your customer users the pre-paid debit card they interact with their local store and online. This allows you to analyse their spending behaviours which will allow you to understand them better, mine their data and information, and tailor your offerings and services to them based on their spending habits.

Or perhaps let’s say you are the manager of an airline and you want to offer your customers an online loan to allow them to buy tickets directly from your website. This way your customers can finance their holidays without 3rd party interruptions and allows you to manage that all-important customer journey.

In short, its 3rd party short-term finance offerings to increase your customer base and improve the per head spending of existing customers.

Banking as a Service or (BaaS) is a way in which banks integrate their digital banking services directly into the products of non-financial institutions.

This is becoming a strong play for Neobanks as due to their reliance on technology and multilayer workflows it’s a lot quicker and easier for them to integrate these types of offerings. Some are already offering setup API and Micro Services to retailers with this in mind so they can be easily incorporated into the existing customer journeys.

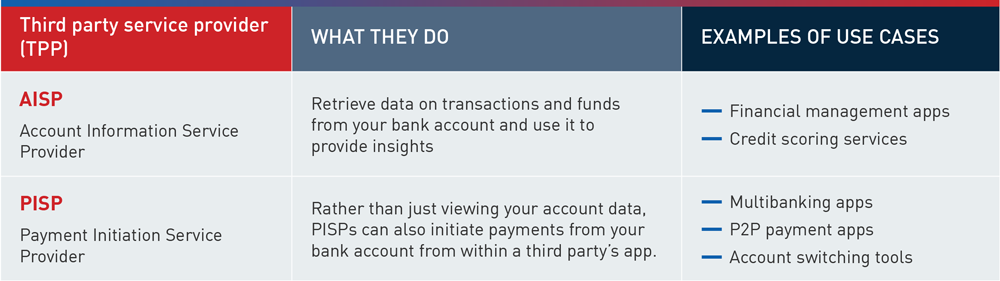

Some examples of this can be found in the table below.

If you take this to the next level if a company is already with a Neobank for its main banking requirements and they are interested in banking as a service to their own customer base.

It is a very quick and easy to assume they would then look at their own digital bank for these types of offerings which they can then look to improve and increase their own offerings to their customers.

Neobanks and the Start-up Benefit

The benefits to Start-ups utilising Neobanks are multi-layered, primarily through technology offering greater benefits:

- Highly personalised, interactive, and intuitive.

- Quick sign-up process.

- Easy to use applications with minimal human interaction.

- Lower cost of entry and usage, lower monthly fees, lower transaction fees.

- Quick easy credit process.

- Analysis and tracking capabilities.

- Third-party offerings and partnerships, with extended benefits.

One of the primary factors above all these however is mobility. As a small business owner, you can be on the other side of the world and deal with most things through their App or website in minutes, whilst with traditional banks, this is generally not the case, even if they try to convince that it is.

Conclusion

Business banking is changing there is no doubt of that. In large part that is due to the change in habits from consumer banking and Neobanks becoming mainstream in that arena. It therefore makes sense that business banking will follow since there is a higher gross profit return per customer as opposed to consumer banking.

I do believe that Neobanks will bring a total change to the global finance ecosystem over time. As they start to become the mainstay for B2C they will soon become the mainstay for B2B. One area which I touched on very briefly is payment providers. This area is starting to explode in the tech space specifically B2B payment providers, so watch out for my upcoming posts where I will be exploring payment providers and business banking in more detail.

Insights

Business improvement through automation is a strategic investment. So it comes as no surprise, we often get asked what is best practice …

How Would You Like To Pay For That?

As we have all seen, there is somewhat of a revolution happening in the payments market globally. In 2020, the payments gateway …

Battle Of The Banks

It’s safe to say that Neobanks are winning the “Hearts and Minds” campaign with their users having the deep-seated roots of wanting to challenge and move away from traditional banks.

Digital Banks, Neobanks and “digital disruptors” have already started cutting into the revenues of the traditional and financial markets and institutions.