Where to Start?We began our journey into Intelligent Document Processing with a large healthcare contract 8 years ago. The challenge was to …

In my blog ‘Access Is Authorised’, I looked at Open Banking and the benefits I believe it’s going to bring to the B2B market. There is, however, a lot of tech sitting behind that making it effective, robust, and frictionless.

Intelligent onboarding has fast become a key requirement to make benefit from Open Banking in the B2B markets. This is fundamentally due to the compliance and regulatory checks which are needed to onboard a new merchant or customer with no human interaction.

So what compliance checks are required?

- Sanction List Checks

- KYC (Know your customer)

- AML (Anti-money Laundering)

- Biometric ID-Checks

- UBO – Ultimate Beneficial Owner

- PEP (Politically Exposed Person)

- Bank Account Validation

This is a list of the top 7 requirements when looking at the API calls needed to onboard a new merchant provider, but there are many more such as adverse media screening, cryptocurrency provider checks to name a few. That is a lot of API calls to onboard a customer in under 5 minutes!

There are a host of providers out there who are focused on the B2C space as the onboarding process is simpler but higher volume. These solutions don’t fit B2B requirements, resulting in the market being under-served.

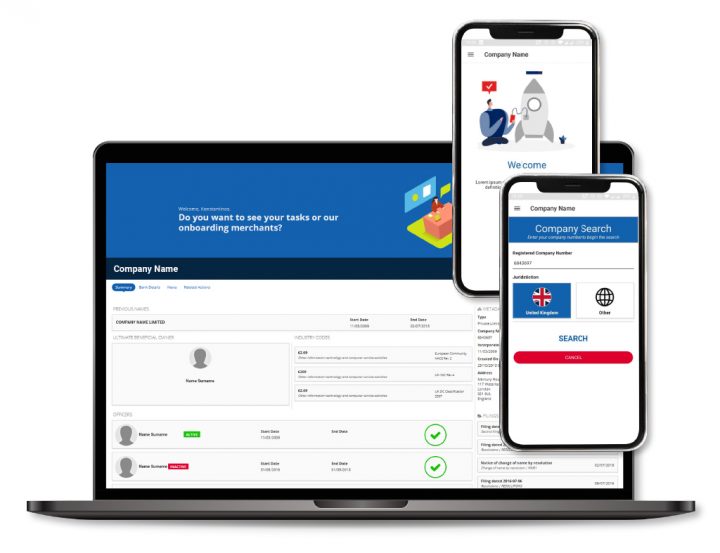

Having spent a lot of time looking into this vertical, we have addressed the market challenges by developing a core solution providing intelligent onboarding. Our B2B solution incorporates carefully selected partners. such as RoundTurn Partners and Veridas for biometric ID verification.

The solution we have developed through my 90-day accelerator program has Appian at its core managing the API call requirements, case management, periodic checks KYC, AML. Veridas is embedded into Appian for Biometric ID-Checks providing a frictionless solution for onboarding allowing accounts to be opened within 5 minutes, instead of days or weeks, with little to no human interaction in the middle and back office.

There are core workflows for low, medium, and high-risk customers with multi-layer automation and if required, technology-assisted intervention and assessment. Our intelligent onboarding solution is specifically designed to meet ongoing regulatory requirements covering periodic checks and full case management.

The B2B space having more complex regulatory requirements means customers need a solution that can handle 100% technology-driven intelligent automation for compliance checks. 15% of cases needing manual intervention and approval will be technology-assisted and automatically flagged. When dealing with 100’s and 1000’s of new merchants per week manual processing becomes impossible. We have already shown to our customers how this solution will save them time, money and more importantly it is an exact fit, first-time-right solution that will grow at scale with them as their business grows and expands.

Reach out to me on the details below for further information or to arrange a quick demo, the solution is that good the demo takes no more than 15 minutes.

David Landi – Head of Asset Management

E: David.landi@pskinetic.com

www.linkedin.com/in/david-landi/

Insights

Business improvement through automation is a strategic investment. So it comes as no surprise, we often get asked what is best practice …

How Would You Like To Pay For That?

As we have all seen, there is somewhat of a revolution happening in the payments market globally. In 2020, the payments gateway …

Want To Reduce Your B2B Onboarding To A Few Minutes?

It Is Time To Put Intelligence Into Onboarding.

Our latest report ‘Intelligent Onboarding’ looks at the complexities of onboarding and how automation reduces time to onboard to minutes.

Want To Reduce Your B2B Onboarding To A Few Minutes?

It Is Time To Put Intelligence Into Onboarding.

Our latest report ‘Intelligent Onboarding’ looks at the complexities of onboarding and how automation reduces time to onboard to minutes.