10 years at Goldman Sachs: 10 years at psKINETIC “Goldman Sachs has clearly shaped your approach to building psKINETIC,” a colleague said …

Private Capital: Digital Transformation of Deal Due Diligence

What do the most successful private equity, private debt, and other alternative asset managers have in common? They are building scalable machines.

This article looks at how digital transformation of the Deal Due Diligence is at the core of building that industrial organisation. We define Deal Due Diligence as the stage from the decision to invest (time & resources), encompassing the due diligence of an opportunity, through to signing and funding.

From Deal Junkies to Lean Six Sigma & IPOs?

The management of private capital has and continues to undergo a transformation, from one-shot big LBOs and Deal Junkies (think Barbarians at the Gate) to a focus on building scalable, data-driven machines for sourcing, executing, monitoring, and realizing investments.

Managing Partners are no longer asking ‘how can we source and close this deal?’ but rather asking ‘how can I build a team and a machine that can evaluate, and close multiple deals every month, year in and year out?’

Value is no longer ‘just’ created through carry and other fees but through the creation of the organisation itself; witness the rapid growth of investments into asset managers focused on private markets with a growing interest for IPO given attractive valuations (e.g. Blue Owl Capital investing in its partner Silver Lake Partners to provide IPO exit of $ABNB).

Deal Due Diligence: The messy process between DealCloud/CRM and funding

Sourcing is critical and the industry has been swift in deploying systems to help the sourcing process; the solution DealCloud, probably the most successful private markets ‘CRM’ solution, implemented at pace across many of the larger players.

Attention is now turning to the trickier (but more rewarding) area of digital transformation of the Deal Due Diligence process itself. Unlike sourcing, this process is more complex and more tailored to the specific asset manager’s niche. A P.E funds-to-funds organisation has different challenges to an individual leading a buy-out or a team providing direct lending to SMEs.

Deal Due Diligence Challenges (or how Napoleon was successful)

Driving a deal towards a successful outcome is a bit like coordinating the D-Day landing. You need to combine great investment acumen with a complex, often confidential, logistics operation. Closing a transaction involves an army of lawyers, auditors, and various consultants. Napoleon was a great strategist, but if you are looking to repeatably win big battles, consider his advice “The amateurs discuss tactics: the professionals discuss logistics”.

![]()

Email & Excel…really your best armament?

Deal Due Diligence moved from fax to email a decade or two ago. As deal complexity, size and volumes have all exploded email & excel (plus some document management) have remained a stubborn part of Deal Due Diligence.

Email and excel can be excellent tactical tools however you are not going to build a machine by relying on solutions that offer poor process control, poor structured data capture and therefore poor visibility – whether at a firm-level or individual transaction.

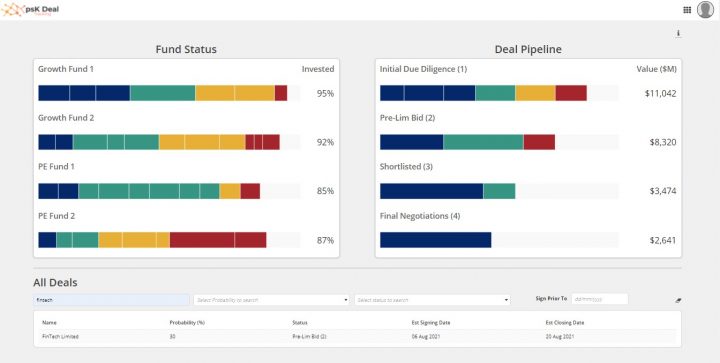

What the General (Managing Partner) needs: Big-picture visibility, good data quality

Asset managers are increasingly trying to drive out incremental returns from their portfolio by demanding better data from portfolio companies. If this makes sense for portfolio companies, it probably makes just as much sense for your own organisation.

Email & excel is not going to give the Managing Partners the big-picture visibility of the deal pipeline, upcoming capital commitments, deal risks and the use of the team they require.

What the Deal Captain (and the Associated) needs: A tool to coordinate a platoon of mercenaries

Consider the number of parties that needs to be coordinated to execute a deal:

Have we appointed legal counsel? Are there any issues with the environmental report? Have we completed KCY/AML? What is the status of our co-investors?

The Solution: Deal Due Diligence Platform…all in one place

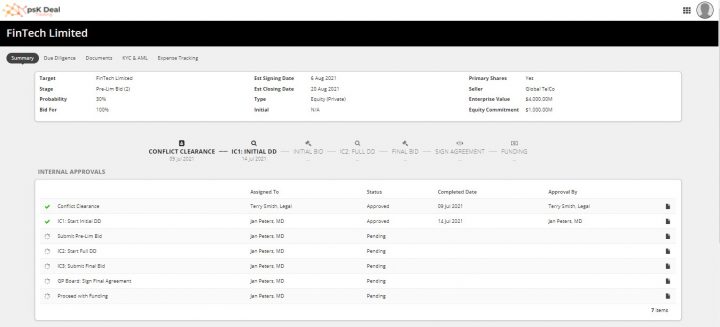

The Deal Due Diligence Platform is a solution that effectively and securely coordinates both internally and externally, people and processes. Instead of emails flying around plus activities being tracked in disparate documents, an all-in-one platform can support activities ranging from keeping track of internal approval processes to coordinating various stakeholders (e.g. tax and legal) and all the way to coordinating the funding process.

The Solution: Deal Due Diligence Platform…tailored to your processes

Every firm has unique investment and financing strategies. The Deal Due Diligence Platform is not an off-the-shelf solution, but a highly configurable platform tailored to your processes, and you’ll own all the IP (your data, your own individual processes).

We support you by tailoring the solution to your specific own approval process (which may vary by fund); your own approach to due diligence, mandate compliance and working with co-investors plus so much more.

The result? Big-picture, accurate reporting to the General, an effect tool for the Deal Captain offering immense value for your machine as you bid to scale.

The Solution: Deal Due Diligence Platform…up and running in 90 Days

Your operations and deal due diligence is most likely creaking under the weight of a large pipeline of investment opportunities.

Contact Alex Tyler to set up a demo/discussion on how we can support you in building a deal due diligence machine, delivering the first results in 90 Days or less.

Alex Tyler – Head of Alternative Capital Markets

Email: alex.tyler@pskinetic.com

Tel: 07412 665914

www.linkedin.com/in/alex-tyler-39275b66/

Insights

Ingolv T Urnes: The Goldman Memoirs – Part Two

No Mission Impossible: Snowstorm & Car Crash Another part of the DNA was this idea of never giving up. The deal or …

Ingolv T Urnes: The Goldman Memoirs – The Great Finale

On Trust, Speed and Risk (Management) Reading about Goldman in the popular press in the nineties and the noughties, you may have thought this is a big …

Tech & Data: Why Is Everything Taking So Damn Long?

In my discussions with senior leaders of Alternative Asset Management firms, I often hear the same refrain: “why is it taking so damn long?” or “when am I actually going to see return on my tech or data investment?”

Want a solution? Then check out these 6 Rules.

Tech & Data: Why Is Everything Taking So Damn Long?

In my discussions with senior leaders of Alternative Asset Management firms, I often hear the same refrain: “why is it taking so damn long?” or “when am I actually going to see return on my tech or data investment?”

Want a solution? Then check out these 6 Rules.